Have you ever thought about how rules about money affect the economy?

Welcome to the world of monetary policy. This is like a guidebook for how money is managed by big banks to keep things steady and help them grow. Learn how choices about interest rates and the amount of money available can change markets and influence things like prices and jobs.

Whether times are good or tough, knowing about these rules is key to seeing the big picture.

Find out how these money rules touch everyday life and guide the future in exciting ways around the world.

Control of Interest Rates

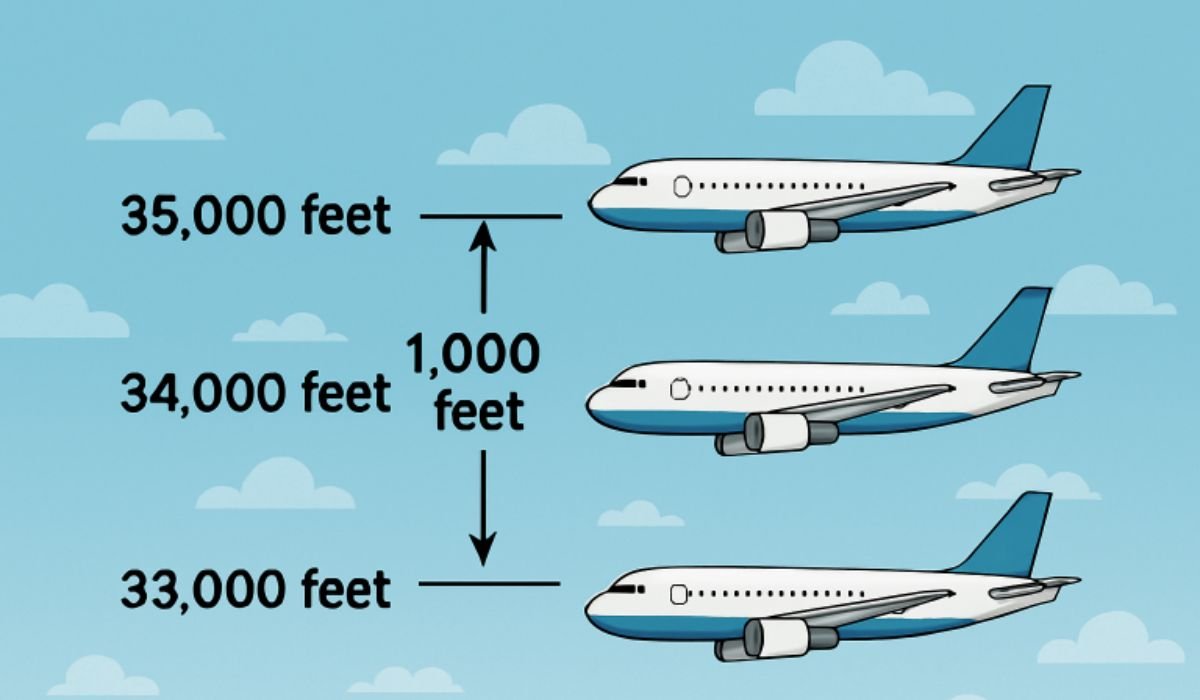

Interest rates are like a dial that central banks turn to help guide the economy. If rates go up, borrowing money costs more, and people may spend less. This can slow things down and keep prices from rising too fast.

If rates go down, it’s cheaper to borrow, making it easier for people to buy things and for businesses to grow. These changes can affect supply chains, as businesses might change how much they produce or stock based on what people are buying.

Keeping an eye on these shifts is important, as not managing them well can lead to problems like deflation, where prices drop and hurt the economy.

Regulation of Money Supply

Imagine the economy as a flowing river, with money being the water that keeps everything moving smoothly. By adding or removing money from this flow, central banks can influence how fast or slow the economy moves.

If there’s too much money, prices can rise too quickly, which isn’t good. On the other hand, too little money can make it hard for businesses to grow and for people to get loans.

These changes can lead to supply chain excess, where too much or too little is produced. Keeping the flow just right helps people buy what they need and encourages them to save money, ensuring a balanced and healthy economy.

Inflation Targeting

Central banks often set a goal for how much prices should rise each year, known as inflation targeting. By aiming for a steady price increase, they try to keep the economy stable and predictable.

This helps people and businesses plan for the future. If prices rise too fast, it can be hard for people to afford things. But if prices fall, due to deflationary factors, it can signal trouble, as businesses might earn less, leading to fewer jobs.

Exchange Rate Management

Think of exchange rates as a balance between different countries’ money. By managing these rates, a country can control how its money trades against others. This helps keep prices steady for things we buy from other countries and sell to them.

If our currency is strong, buying foreign goods is cheaper, but selling our goods abroad can be harder. If it’s weak, selling outside becomes easier, but buying from other countries costs more. This balance is key for a stable economy.

Wrapping Up: The Power of Monetary Policy in Shaping Our Economy

Monetary policy is key in keeping our economy steady. It helps control how money moves and affects prices. This balance is important for businesses to grow and for people to plan their spending.

By understanding how monetary policy works, we can see why it matters in keeping our economy strong. As we look ahead, knowing its role helps us feel more confident in handling our financial world and its ups and downs.

Did you find this article helpful? You can check out our website for more awesome content like this.