Staring at a dozen browser tabs filled with lender jargon, interest rates swimming before your eyes, and that knot of anxiety tightening in your stomach? Yeah, we’ve been there. Finding the right private student loan shouldn’t feel like cracking a secret code or running a marathon in paperwork. What if comparing your options felt as effortless as scrolling through your favorite online store? That’s the reality platforms like traceloans.com student loans marketplace are creating. Forget the overwhelm; let’s talk about finding clarity and control.

What is traceloans.com? Your Student Loan Marketplace Explained Simply

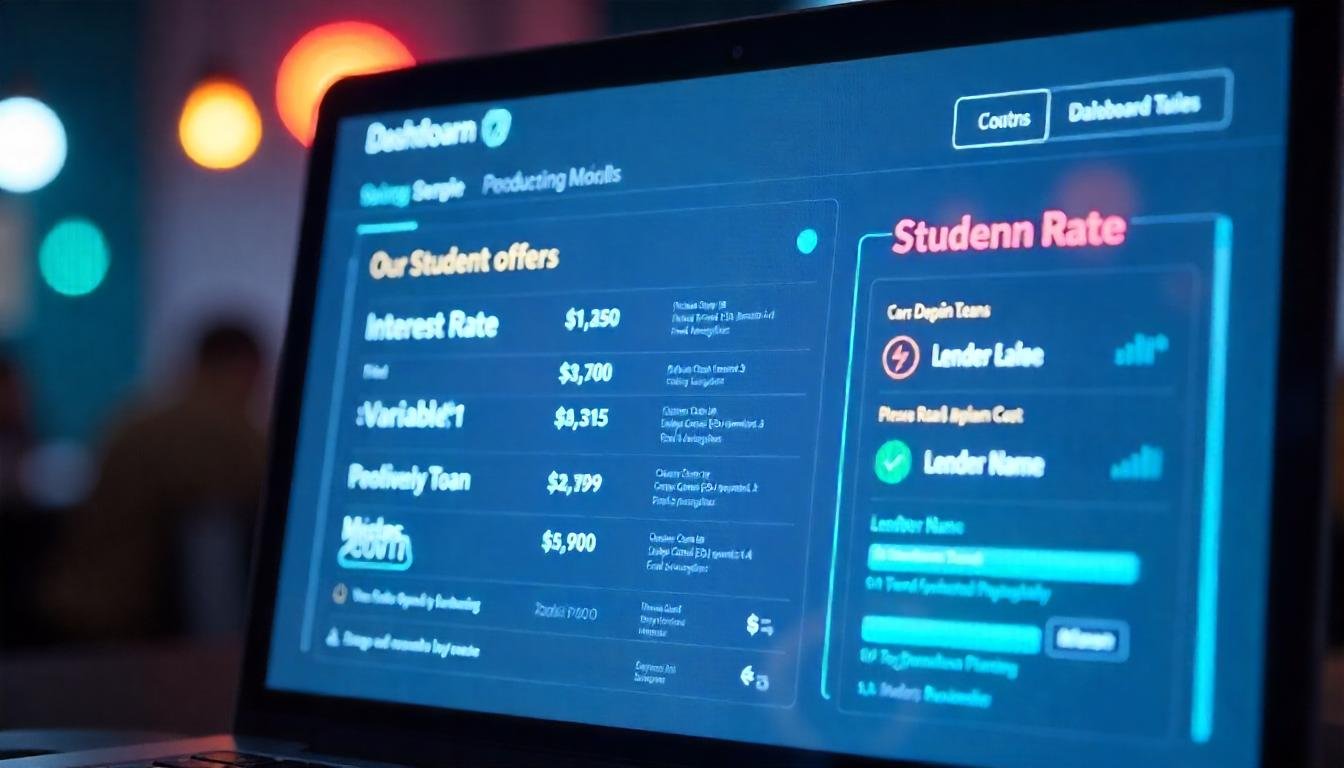

Think of traceloans.com less like a traditional bank and more like your personal, ultra-efficient loan matchmaker. Instead of you trudging from lender website to lender website (and getting lost in the fine print jungle), traceloans.com student loans marketplace does the heavy lifting. It gathers offers from a wide network of private student loan lenders and presents them to you in one clear, easy-to-understand dashboard. It’s not the lender itself; it’s your powerful comparison hub. Imagine instantly seeing multiple loan options side-by-side – rates, terms, monthly payments – without needing a finance degree to decipher them. That’s the core promise.

How the traceloans.com Process Actually Works: Your Step-by-Step Guide

Wondering if it’s complicated? It’s designed to be the opposite. Here’s the typical journey:

- Share Your Basics (It’s Quick & Painless): Head to the traceloans.com website. You’ll answer some straightforward questions: What school? What degree? How much do you need? Basic financial info (like income and housing costs – estimates often work fine initially). This takes minutes, not hours.

- See Potential Matches (No Credit Score Hit!): Crucially, this initial step usually involves only a soft credit inquiry. That means traceloans.com and its partner lenders can give you a realistic picture of potential rates and lenders likely to approve you without impacting your credit score. Breathe easy!

- Compare Offers Side-by-Side (The Magic Moment): This is where the marketplace shines. Instead of scribbling notes on scraps of paper, you see your pre-qualified offers neatly displayed. Compare interest rates (fixed and variable), monthly payments, total loan costs, repayment terms, and lender names – all in one spot. No more mental gymnastics.

- Choose & Apply Directly: Found an offer that fits? Great! You’ll click through to the lender’s own website to complete the formal application. This is when a hard credit pull might happen, but only with the lender you choose. traceloans.com facilitates the connection, making it seamless.

- Fund Your Education: Once approved by the lender, the funds are sent according to their process (often to your school).

Why Choose a Marketplace? The Undeniable Benefits of traceloans.com Student Loans

Why bother with a marketplace like traceloans.com instead of going direct? The advantages are compelling:

- Save Serious Time (and Sanity): Ditch the endless Googling and tab overload. Get multiple potential offers in minutes, not days or weeks spent hopping between lender sites.

- Unlock Better Rates & Terms: Seeing offers side-by-side empowers you to spot the genuinely best deal for your situation. Competition works in your favor.

- Discover More Options: Banks and credit unions you might not have considered (or even known existed) could be part of the traceloans.com network, broadening your possibilities.

- Streamlined Experience: One simple form starts the process. Less paperwork chaos upfront.

- Credit-Smart Approach: The initial soft inquiry lets you explore possibilities risk-free before committing to a formal application.

| Feature | Traditional Lender Search | traceloans.com Marketplace |

|---|---|---|

| Compare Offers | Visit sites individually, take notes | View offers side-by-side instantly |

| Initial Speed | Days or weeks for multiple quotes | Potential offers in minutes |

| Credit Flexibility | Often strict criteria per lender | Wider range of lenders for diverse profiles |

| Digital Tools | Rare or very basic | Integrated calculators, AI guidance, reminders |

| Paperwork Burden | Can be high, repetitive per lender | Minimized & streamlined initial process |

| Pre-Qualification | Not always available, may require hard pull | Soft credit check for initial rates |

Also Read: Blog Post: Caricatronchi – The Forest’s Mighty Workhorse You Never Knew About

Beyond Comparison: traceloans.com Tools to Master Your Repayment

traceloans.com student loans isn’t just about finding the loan; it’s about setting you up for success after you borrow. Many marketplaces offer powerful tools:

- Personalized Repayment Calculators: Don’t guess! Plug in your loan amount, interest rate, and term to see exactly what your monthly payment will be and the total interest you’ll pay over time. Experiment with different terms to find what fits your budget.

- AI-Powered Guidance: Some platforms offer insights or suggestions based on your profile and goals, helping you understand the implications of different choices.

- Automated Payment Reminders: Life gets busy. These nudge you so you never miss a payment and protect your credit score.

- Resource Hubs: Look for articles, glossaries, and FAQs to boost your financial literacy.

Credit Worries? How traceloans.com Caters to Real Borrowers

“My credit isn’t perfect. Am I even eligible?” This is a huge, valid concern. One major strength of using a marketplace like traceloans.com is its inclusivity.

- Network Diversity: They partner with lenders who specialize in different credit profiles – including those who understand fair credit, limited credit history, or the value of a co-signer.

- Finding Your Fit: Instead of facing instant rejection from one traditional lender, the marketplace can match you with lenders whose criteria align better with your situation. Having a creditworthy co-signer can dramatically expand your options and potentially lower your rate.

- Transparent Exploration: The soft inquiry pre-qualification lets you see what’s realistically possible for you without any risk to your score. No more applying blindly and hoping.

Speed & Simplicity: The traceloans.com Advantage for Your Busy Life

Let’s face it: You’re juggling classes, maybe a job, a social life, and the general chaos of young adulthood. Searching for loans shouldn’t be another massive time sink. traceloans.com student loans marketplace is built for efficiency:

- Quick Pre-Qualification: Get a snapshot of potential rates incredibly fast.

- Minimal Upfront Hassle: One streamlined form replaces countless duplicate applications.

- Digital-First Process: Manage everything online – no need for endless branch visits or faxing documents (seriously, who faxes anymore?).

- Flexible Matching: Whether you need funds for next semester, want to cover a financial aid gap, or are exploring refinancing options later, the marketplace adapts to your specific timing and need.

Smart Borrowing: Getting the Most Out of traceloans.com

Ready to dive in? Here’s how to make your marketplace experience even smoother:

- Gather Your Essentials: Before starting, have handy: Your school name/cost of attendance, desired loan amount, basic income/expense info (approx. is fine for pre-qual), and Social Security Number for the soft check. If you’re considering a co-signer, talk to them upfront!

- Be Honest & Accurate: Inputting correct information ensures the offers you see are truly relevant and achievable.

- Look Beyond the Lowest Rate: While the interest rate is crucial, also compare the APR (includes fees), repayment term length, monthly payment amount, total repayment cost, and any borrower benefits (like autopay discounts or cosigner release options). Use the tools!

- Read Lender Details: Once you narrow down options, click through to the lender’s site. Carefully review their specific terms, conditions, fees, and eligibility requirements before formally applying.

- Ask Questions: Reputable marketplaces have customer support. Don’t hesitate to reach out if something isn’t clear.

The Bottom Line: Take Control, Not Just a Loan

Navigating private student loans can feel daunting, but it doesn’t have to be a solo mission through a maze. Platforms like traceloans.com student loans marketplace exist to cut through the noise, save you precious time and energy, and connect you with lenders that might be the perfect fit – even if your credit history isn’t textbook perfect. By offering side-by-side comparisons, credit-friendly exploration, and powerful repayment tools, it empowers you to borrow smarter.

Your Next Steps Towards Easier Borrowing:

- Visit traceloans.com: See the interface for yourself. It’s designed for clarity.

- Spend 5 Minutes on Pre-Qualification: See what potential offers look like for you – it’s risk-free and insightful.

- Play with the Calculators: Before you commit, understand the real cost of different loan options over time. Knowledge is power (and savings!).

What’s the one thing about student loans that stresses you out the most? Could seeing all your options clearly in one place help? Share your thoughts below – let’s demystify this together!

You May Also Read: UGA eLC: Your All-Access Pass to Seamless Learning at Georgia

FAQs

Q: Is traceloans.com a direct lender?

A: No. traceloans.com is a marketplace. They connect borrowers like you with multiple private student loan lenders, allowing you to easily compare offers in one place. The loan itself comes directly from the lender you choose.

Q: Does checking my rates on traceloans.com hurt my credit score?

A: Checking your initial pre-qualified rates typically uses only a soft credit inquiry, which does not affect your credit score. A hard inquiry, which can slightly impact your score, only happens if you formally apply with a specific lender after choosing an offer.

Q: What kinds of student loans can I find through traceloans.com?

A: traceloans.com primarily focuses on aggregating offers for private student loans. These can be used for undergraduate, graduate, professional degrees (like law or medicine), and sometimes even for refinancing existing student loans. It’s great for covering gaps after federal aid.

Q: Can I use traceloans.com if I have bad credit or no credit history?

A: Absolutely! A key benefit is their network includes lenders who cater to various credit situations, including fair credit or limited credit history. While the best rates usually go to those with strong credit, having a creditworthy co-signer can significantly improve your options and potential interest rates found through the marketplace.

Q: How does traceloans.com make money? Is it free for me?

A: Generally, marketplaces like traceloans.com earn a fee from the lender when a loan is successfully originated through their platform. There is usually no direct cost to you, the borrower, for using their comparison service. It’s free to check your rates and compare offers.

Q: What information do I need to get started with traceloans.com?

A: To get pre-qualified rates, you’ll typically need: Your name, date of birth, contact info, school name and cost of attendance, desired loan amount, citizenship status, and basic financial details (like approximate income and housing costs).

Q: Are there other marketplaces like traceloans.com?

A: Yes, other student loan comparison platforms exist (like Credible, Earnest, or LendKey). It’s always wise to explore different tools! traceloans.com differentiates itself through its specific lender network, focus on user-friendly comparison tools, and emphasis on serving borrowers with diverse credit profiles.